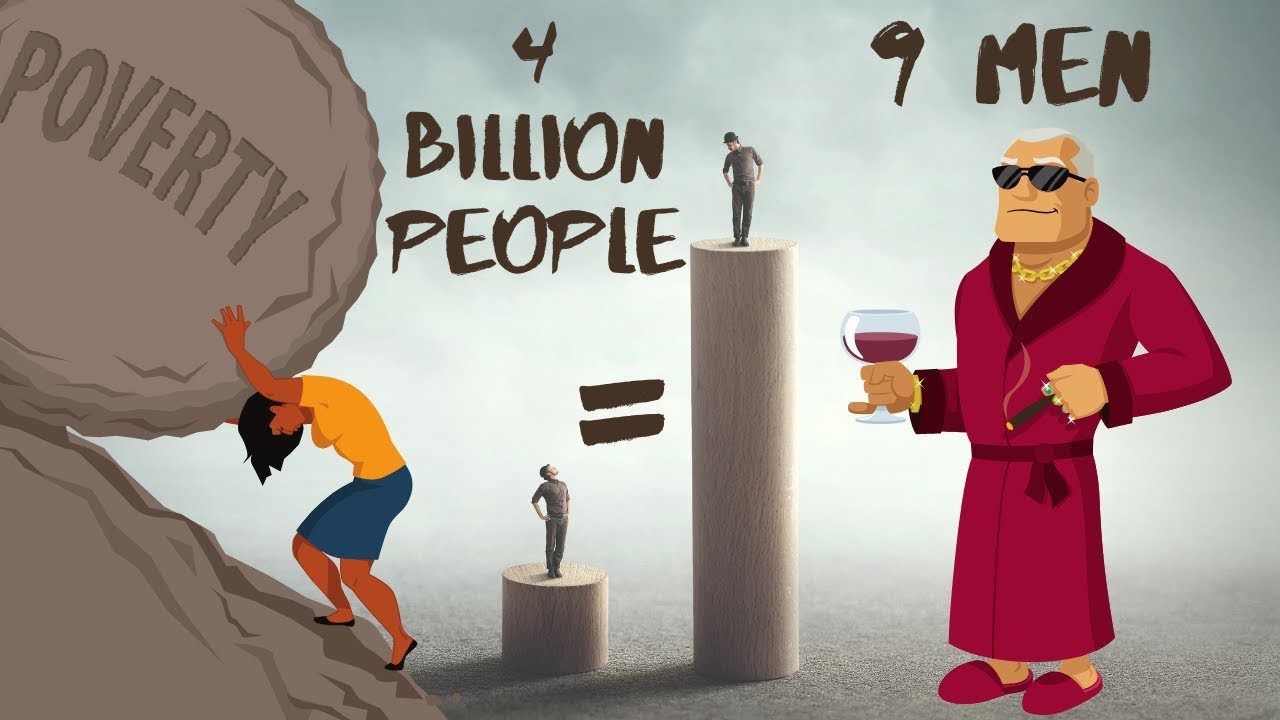

In the United States, homeownership is seen as the most effective way to build generational wealth, with the average homeowner having a household wealth of $231,000 dollars compared to the average renter having a household wealth of just $5,200 dollars.

But data shows discriminatory policies left many Black Americans out of the economic picture, and the problem is only getting worse. If you look at the 100 U.S. cities with the largest population of Black households today, every single one of them shows a growing divide between Black and White homeownership.

Read more here at CNBC Make It:

For more than 30 years, Parker McAllister’s parents have owned a brownstone in the Brooklyn, New York. They purchased the home for about $91,000 in 1985 and currently have three tenants in the Bedford-Stuyvesant multi-family property so they can keep up with mortgage payments.

McAllister, 29, hopes to one day take over the home. Right now, he says, he’s mentally prepared to take on the responsibility, but not financially, as his parents still owe money on the home. “I would have to [think] about us refinancing again in order to get a lower rate,” he told CNBC Make It. His parents refinanced their home once after losing their jobs in 2008 at the height of the Great Recession.

McAllister, who is a musician, says that showing proof of income to refinance would be extremely difficult. Currently, he’s relying on unemployment and side-hustle money from producing music to make ends meet since most of his shows have been canceled due to the coronavirus pandemic.

» Subscribe to CNBC Make It.:

About CNBC Make It.: CNBC Make It. is a new section of CNBC dedicated to making you smarter about managing your business, career, and money.

Connect with CNBC Make It. Online

Get the latest updates:

Find CNBC Make It. on Facebook:

Find CNBC Make It. on Twitter:

Find CNBC Make It. on Instagram:

#CNBC

#CNBCMakeIt

source